In today’s digital age, we are all guilty of spending too much time glued to our mobile phones, tablets and other digital devices to access the internet.

In fact, if you are reading this you probably find yourself in that predicament right now!

Many commentators believe that web 3.0 is on the immediate horizon, where blockchain technologies such as cryptocurrencies and non-fungible tokens (NFTs) are the norm. Bloomberg has described web 3.0 as something that “would build financial assets, in the form of tokens, into the inner workings of almost anything you do online.”

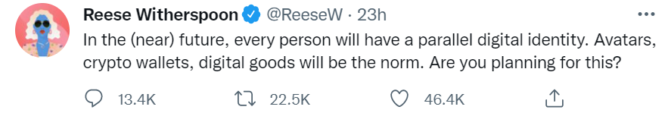

Reese Witherspoon, the well-known American actress, producer and entrepreneur, posted on Twitter this week:

You will also need to have a plan for this for your digital assets when you die, so that your loved ones can access these assets as you wish.

Apple have just released a new feature available on iOS15.2 called ‘Digital Legacy’. Digital Legacy allows you to pass on your Apple information to your friends and family once you pass away giving them access to your photos, notes, reminders, text messages, phone log and much more.

Whilst the new Digital Legacy app is great for Apple users, the app alone does not go far enough to ensure our digital afterlives are well planned for in the event of death.

Loved ones or the executor of your Will may require access to individual apps and websites which Apple are not responsible for. For example, if you own cryptocurrency or have NFTs you have one unique (often complex multi-word) password to access your digital wallet electronically. If this password is lost or forgotten you will lose the crypto or access to your digital wallet forever irrespective of its value. This means that your cryptocurrency and digital assets could easily disappear and not form part of your estate for the benefit of your family, or the beneficiaries named in your Will.

Your social media accounts are another thing to consider. For example, Meta’s (formerly known as Facebook, Inc which manages Facebook and Instagram – two of the most popular social media platforms) data policy does not make any reference to bereavement and whether or not they will give your family access to your accounts when you pass away. The policy simply states, “We access, preserve and share your information with regulators, law enforcement or others, in response to a legal request, if we have a good-faith belief that the law requires us to do so”. This statement therefore infers that without a court order, the company will not comply with a grieving families request. It is therefore important to store your passwords somewhere safe so that apps and websites can be accessed, if required, when you are no longer here.

Preparing for the digital afterlife

The first step in making provision for your digital assets is to clearly identify them and keep a record of them for the benefit of your family and executors. Several providers, for a fee, now offer an online “safety deposit box” in which you can store your usernames and passwords. Those details will then be made available to a nominated person following your death. Examples of these providers are Legacy Locker, Assetlock and Deathswitch. An alternative is to keep a written list of accounts and access details in a safe place. This should not be included in a Will directly as, following deaths in Scotland, Wills become public documents.

The difficulty with both approaches is that you must keep your list of passwords up to date. The law in Scotland has not greatly evolved to give clear instruction on what should happen to digital assets when someone dies. It is however certain that it will develop as more unfortunate cases arise and the digital afterlife should be considered essential when carrying out careful estate planning.

Book a free initial telephone consultation regarding your Will with Neilsons here